The Price-to-Earnings Ratio or P/E ratio is a ratio for valuing a company that measures its current share price relative to its per-share earnings, and is a commonly used statistic for stock evaluation. Many of the major automakers, save for Toyota, are projected to have stable P/E ratios over the next three years. Ford has a current ratio of 6.9, General Motors with a 6.08, and Fiat Chrysler with a 5.22. Each of these companies are projected to maintain these numbers within a relatively small margin between now and 2018. Toyota is more interesting, however, as in 2019 their ratio is projected to fall off a cliff from an estimated 7.89 in 2018 to 0.10. Yet even with this sharp shift, all these established automakers have a positive P/E ratio primarily ranging between 5 and 7.

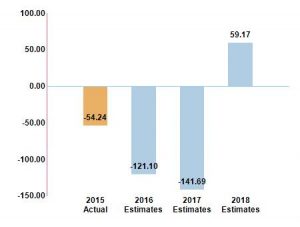

Tesla is a major outlier in the industry in terms of P/E (shown on the right), which has become normal for the electric car maker. In 2015 their price-to-earnings ratio was -54.24, and is estimated to bottom out at -141.69. These numbers are shockingly low, but even more surprising is the projected number for 2018, a positive 59.17. I suppose this massive number may be enough to entice investors to weather the storm for the next few years as Tesla ramps up production for the new Model 3 and attempts to produce a profitable quarter for the first time without the selling of government carbon credits. If Tesla is able to achieve a ratio of anywhere near 59.17, it will be a full magnitude higher than any of their competitors.

I am not convinced that Tesla will ever be able to achieve a P/E of 59.17, or a positive ratio at all for that matter. They are behind in terms of battery production for the Model 3 and are currently only making money by selling carbon credits. Investors should be very wary of Tesla right now.

I agree with Michael; however, I do think that we should be paying close attention to Tesla in the next few quarters- even if they continue to lose money, there is much for an older auto company to learn from a new tech-based company like Tesla that started with a clean slate in terms of manufacturing ideas and how to run a company.

I agree that people should keep an eye on Tesla because of their sudden emergence in the market. My question, however, is how Toyota’s PE ratio is projected to drop 7.89 to 0.10 from 2019-2019. I’m assuming its the changing foreign exchange market, the appreciation of the Japanese yen, that is the reason for this negative projection.

Although Tesla has had a rocky start, so did other car manufacturers in their early days, such as GM and Ford. Tesla is attempting to break into an oligopoly of domestic car manufacturers. Investors are beginning to see the disruptive impact Tesla could have. The money made on carbon credits provides a great source of income where other manufacturers are losing. As the carbon emissions standards rise, which they are set to do every couple years, the carbon credits will be in greater demand and Tesla can sell at a higher price. Goldman Sachs’ auto analyst recently voiced his endorsement in Tesla stock. Here’s one article explaining why http://www.businessinsider.com/goldman-sachs-teslas-a-buy-2016-5

If Tesla has a market cap of $30 bil, then a P/E of 6 requires profits of $5 bil. With sales of 500,000 cars that requires average profits of $10,000 per car. Not going to happen with most of the volume from a $35,000 vehicle. Those may have $5,000 of options, but that might add only another $3,000 profit.