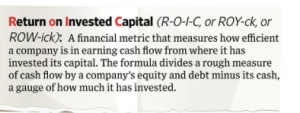

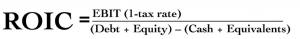

A new metric in finance is taking over the auto industry, specifically General Motors. The automaker started using the metric called ROIC, or return on invested capital, to show how efficiently they earn cash flow from where it has invested its capital. The typical ROIC equation divides a company’s operating income, adjusted for its tax rate, by total debt plus shareholder equity minus cash. It aims to show how much new cash is generated from capital investments. Looking at an example of this in terms of GM’s recent quarters, adjusted operating earnings were $11.4 billion, up from $8.1 billion a year earlier. The denomi nator of the equation (below) shrank as GM reduced, partly via buybacks, its equity, even though debt went up. ROIC rose to 28.5% from 19.5%, showing it was earning more with less. CFO of GM, Chuck Stevens, commented on the effectiveness of the trending metric stating, “ROIC provides the clearest picture of how we are managing our capital and our business. It’s really starting to become part of the DNA of our decisions.” GM is not the only automaker starting to focus on ROIC. Fiat Chrysler Automobiles has taken note of this metric and has publicly called for consolidation to help the whole industry improve its ROIC, even giving a presentation last year titled “Confessions of a Capital Junkie”. The co-heads of activist-defense banking at Goldman Sachs believe that ROIC is near the top of the list of quantitative metrics investors care about and state that a company with a low ROIC is seen as a red flag. ROIC can be seen affecting GM’s decision making early last year when they backed away from a plant in Russia that had been expected to generate significant growth because GM believed it would struggle to earn sufficient returns on the $1 billion needed to invest. This new trending metric has started to influence the auto industry and it will be interesting to see if it spreads across the Detroit Three in the next few years. Thoughts?

nator of the equation (below) shrank as GM reduced, partly via buybacks, its equity, even though debt went up. ROIC rose to 28.5% from 19.5%, showing it was earning more with less. CFO of GM, Chuck Stevens, commented on the effectiveness of the trending metric stating, “ROIC provides the clearest picture of how we are managing our capital and our business. It’s really starting to become part of the DNA of our decisions.” GM is not the only automaker starting to focus on ROIC. Fiat Chrysler Automobiles has taken note of this metric and has publicly called for consolidation to help the whole industry improve its ROIC, even giving a presentation last year titled “Confessions of a Capital Junkie”. The co-heads of activist-defense banking at Goldman Sachs believe that ROIC is near the top of the list of quantitative metrics investors care about and state that a company with a low ROIC is seen as a red flag. ROIC can be seen affecting GM’s decision making early last year when they backed away from a plant in Russia that had been expected to generate significant growth because GM believed it would struggle to earn sufficient returns on the $1 billion needed to invest. This new trending metric has started to influence the auto industry and it will be interesting to see if it spreads across the Detroit Three in the next few years. Thoughts?

Source: http://www.wsj.com/articles/the-hottest-metric-in-finance-roic-1462267809#:vPrdRywTInvzSA

Is there any correlation between the emergence of ROIC as an important financial metric and the increased presence of GM overseas, especially in Asia? It seems that a major investment of capital overseas might prompt a company to monitor closely cash flow from invested capital.

This post is interesting because it highlights the takeover of automakers by finance people who completely divorce the business model from the manufacturing principles that originally defined the auto industry. Dr. Smitka’s comments about the “divorce” of companies from people who understand the mechanics of cars in positions of power definitely applies to this industry trend toward the use of ROIC. I would like to see if economic analysis of finance using the ROIC serves automakers in the long term or becomes too abstracted from reality to matter.

Thomas Barnett

GM’s increased presence overseas most likely factored in ROIC to see the effectiveness of doing so. Like as I mentioned earlier, GM backed out of producing at a new plant in Russia because it did not bring the return they needed to be worthwhile. ROIC is probably a factor in many of GM’s decisions recently and in the coming years because as the CFO stated, “[ROIC] is starting to become part of the DNA of our decisions”.

The development of ROIC began with GM in the 1920s (and perhaps a bit earlier at DuPont). This is a variation on their internal metric of ROI that they have used for almost a century to guide investment decisions across car brands and parts operations. GM served as a model for developing this and other management tools that are central to all large, multidivisional companies (but less necessary in firms that run multiple similar operations, eg Walmart can focus on same-store sales growth, sales per square foot and other “engineering” metrics).

This is not new. What I don’t know is how prominent it would be in the curriculum that a financial analyst would have gone through. Wall Street isn’t always on the leading edge of how to analyze businesses!!